delayed draw term loan vs term loan

They are technically part of an underlying. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

Understanding The Construction Draw Schedule Propertymetrics

The Borrower shall repay 025 of the.

. Compare Offers Apply Now. Like revolvers delayed-draw loans carry fees. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

Dated as of November 16 2010. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come to an end.

For example say you borrow 50000 and pay. Best Personal Loan Companies 2022. This is how Dealstrucks.

Check rates in 2 minutes. See if you prequalify for personal loan rates with multiple lenders. The lenders approve the term loans once with a.

Applying Wont Hurt Credit. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad Get Up to 100K in 24hrs. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be. Subject to the terms and conditions hereof and in reliance upon the representations and warranties set forth herein each Delayed Draw Term Loan Lender. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

In its most basic form a term loan is a lump sum of cash paid back in fixed equal installments usually monthly typically at a fixed rate. Term debt is a loan with a set payment schedule over several months or years. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

EX-101 4 dex101htm CITI DELAYED DRAW TERM AGREEMENT Exhibit 101 Execution Version. Ad Rates with AutoPay See terms. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the.

DDTLs were used in bespoke arrangements by borrowers. The difference between term and revolving debt. Fixed Rates from 349 APR.

Repayment of Delayed Draw Term Loan. The outstanding amount under the Delayed Draw Term Loan if any shall be repaid in quarterly installments. Delayed Draw Term Loan.

Ad Top Home Loans.

Nasmyth Group And Incora Sign An Agreement To Manufacture Precision Engineered Components Engineering Precision Agreement

Lsu Acceptance Letter Is Lsu Acceptance Letter Still Relevant Acceptance Letter Lsu Shreveport Lsu

The Benefits Of Long Term Vs Short Term Financing

Pin On Speaking Activities English

Financing Fees Deferred Capitalized Amortized

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

4 Short Term Loans Personal Loans With No Prepayment Penalty

Advanced Lbo Modeling Test 4 Hour Example Excel Template

Is A Line Of Credit Or Term Loan Right For Your Smb Business Com

Types Of Term Loan Payment Schedules Ag Decision Maker

Federal Versus Private Student Loans Infographic Student Loans Financial Aid For College Federal Student Loans

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Improvement Loans Home Construction

Infographics Types Of Bank Guarantees Bg Providers Trade Finance Bank Infographic

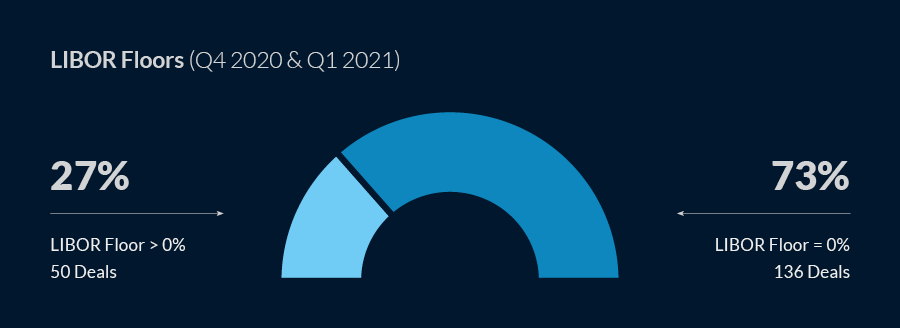

New Libor Floor Provisions Market Trends 2020 2021

Types Or Classification Of Bank Term Loan And Features Lopol Org

/GettyImages-175520675-fad3bb7af6aa4da48f02d47ba57a7432.jpg)